The usa Service away from Agriculture (USDA) is not only from the meat inspections, in addition also provides a home loan program one, according to institution, aided more than 166,000 household see their property possession hopes and dreams into the 2015 by yourself. New USDA Outlying Invention Single Family relations Casing Mortgage Make certain System, otherwise USDA Mortgage, has the benefit of several advantages you will not find together with other loan software. Home buyers have used this bodies-recognized system just like the 1949 to invest in property they didn’t afford by way of conventional pathways by taking advantage of its extreme advantages.

No Down-payment

The most significant, most obvious advantage of an effective USDA financial ‘s the zero down payment criteria. So it saves home buyers a substantial amount of upfront money, that is certainly a test so you can owning a home. Other low-down commission alternatives need limited number one generally initiate in the 3%, however with USDA financing your benefit from zero-down on that loan equal to the brand new appraised property value brand new house are bought. The ability to get 100% investment is one of cited benefit this method will bring.

Easy Applicant Qualifications Requirements

Money are around for applicants having low credit ratings as well as derogatory credit items otherwise restricted borrowing records might not harm your own qualification to possess home financing. The latest USDA possess flexible borrowing from the bank standards compared to the other sorts of fund. Candidates only need a rating regarding 640 having automatic approval, but down credit ratings are often acknowledged which have By hand Underwritten financing, with more strict conditions. The fresh USDA plus doesn’t require the very least a position record in the same work. However, you do need evidence of secure earnings to your earlier one or two decades, especially if you happen to be out of work, as a consequence of taxation statements.

Low Monthly Individual Home loan Insurance policies (PMI)

Whatever the mortgage program, one financing quick loans in Truckee that have lower than 20% down-payment is needed to bring PMI. But not, PMI is a lot more affordable with good USDA mortgage and you can is known as guarantee costs. This type of fees is an upfront and you will annual costs. A new advantageous asset of good USDA financial is these types of costs were a minimal PMI price of every mortgage system. Already, the latest initial commission try 2% and the annual percentage is actually .50%, nevertheless these are ready to help you , based on financial pros such as for example Inlanta Home loan. A secondary work with is the capacity to loans their initial PMI by the running it in the financing, to help you close as opposed to placing any money off.

Aggressive Annual percentage rate (APR)

The zero-deposit USDA mortgage loan doesn’t mean you’ll shell out good large Apr. These types of loans provide comparable, if not down, cost than simply you’ll find having old-fashioned financing or any other specialized home mortgage programs including Government Housing Power (FHA) financing. Since these fund are protected because of the bodies, lenders render low interest rates that will not are very different according to the downpayment otherwise credit history, because they perform that have traditional resource. Your make the most of 15-year and you will 29-year fixed rates of interest one rival this new costs of most other lowest-attention reduced programs.

Low Monthly obligations

Considering the zero-down-payment, you get which have increased funded equilibrium having USDA money, but it is often counterbalance by all the way down, inexpensive PMI and you may age, or possibly lower, than many other mortgage options, and therefore specifically benefits family members into strict costs.

Abundant Area Accessibility

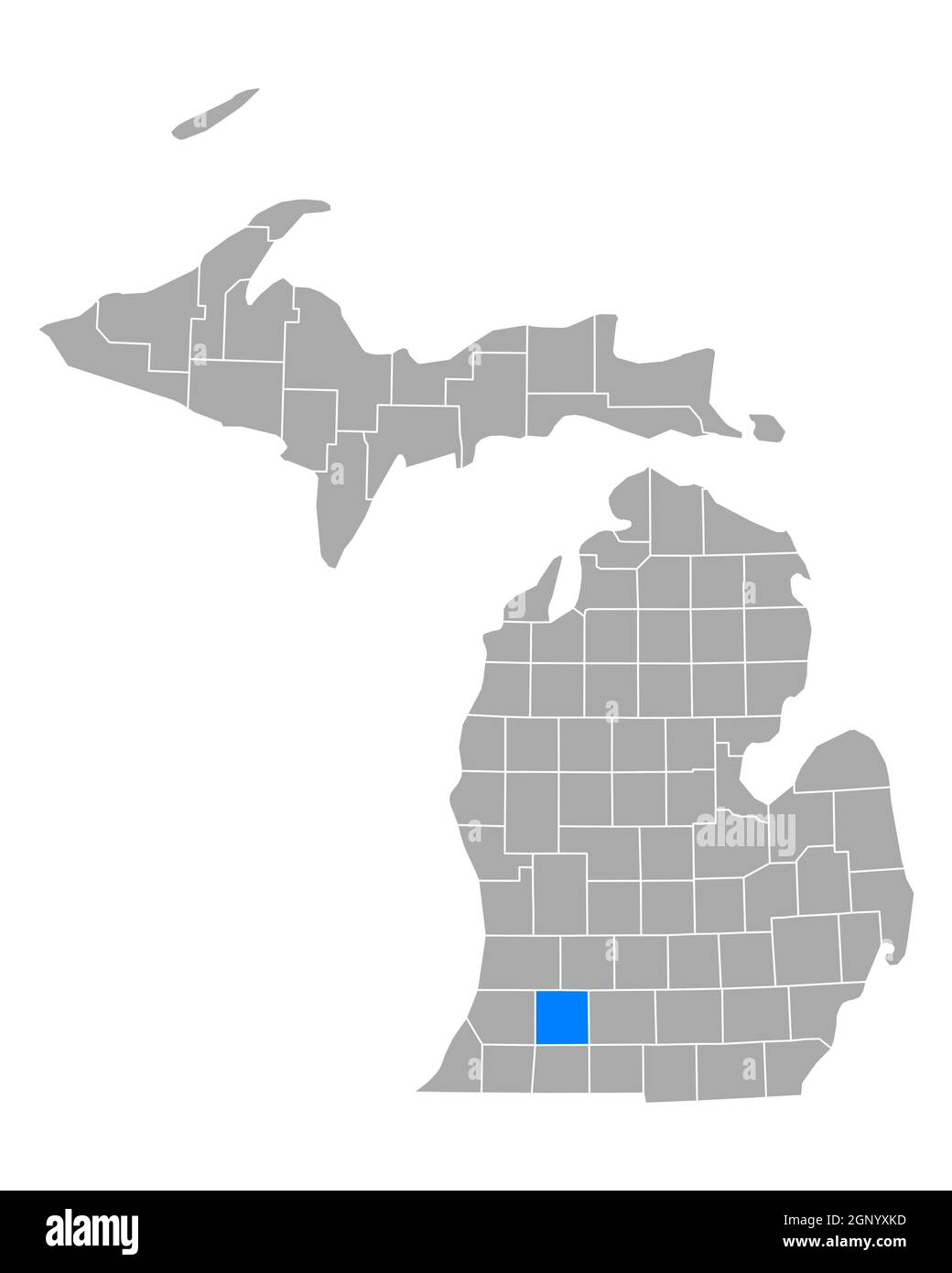

Because the mortgage try given to have “rural” components, the newest USDA definition of rural is liberal. With regards to the Home loan Report, throughout the 97% from end up in new You.S. is approved. Basic guidelines state possible properties have to be in the components which have an effective inhabitants lower than 10,000, otherwise 20,000 within the components deemed getting a critical diminished financial borrowing from the bank getting down/moderate-earnings families. Rural categories aren’t expected to alter up to 2020. Many suburbs out-of towns and cities and you will short towns slip during these guidance. A lot of counties all over the country has many city considered outlying together with very outside lying areas of the most significant locations. Such as for example, Allentown, PA is too highest so you’re able to qualify since a qualified rural city, however, smaller boroughs inside the Lehigh County, such as for example Coopersburg carry out. Rating an over-all concept of qualified places by asking a great USDA qualification map and be sure if or not specific home qualify using your financial lender.

Contemplate, the fresh new USDA does not fund your financial. They people having recognized lenders that happen to be happy to create loans with attractive terms and conditions in order to certified individuals having a repayment be sure off the fresh Rural Development Financial Guarantee System. If you’re there are various great things about an effective USDA mortgage, you’re still subject to all eligibility criteria of your program, so not everybody tend to qualify.

If you purchase an item otherwise register for a free account courtesy an association for the all of our webpages, we would located payment. Using this webpages, you agree to all of our Affiliate Arrangement and you can concur that your own ticks, connections, and personal pointers are amassed, filed, and/or kept because of the you and you will social media and other third-team partners in line with our very own Online privacy policy.

Disclaimer

Usage of and you may/or registration for the one percentage of your website comprises enjoy off our Representative Agreement, (up-to-date 8/1/2024) and you will acknowledgement your Online privacy policy, along with your Privacy Alternatives and you may Rights (up-to-date eight/1/2024).

2024 Progress Regional Media LLC. All of the legal rights booked (Regarding United states). The information presented on this site may possibly not be reproduced, distributed, carried, cached if not put, except into prior authored permission out-of Improve Local.