Go is actually a consumer loan financial one boasts autonomy. This has label choice out-of two to 5 years, mortgage amounts out of $5,000 to help you $50,000, and also the capability to select your own fee due date. Individuals applying with an excellent co-borrower get be eligible for an interest rate disregard.

Achieve pledges same-day choices for the majority individuals and you can capital is possible from inside the 24 to help you 72 period. You are able to prefer just how you would like to implement-to the cell phone with the aid of a realtor otherwise online oneself. Origination charge vary from step 1.99% to help you 6.99%, so keep you to additional expense at heart for people who implement.

Choosing a great co-applicant to possess a consumer loan is actually a critical choice. Not check here only can it impact the mortgage, it may affect the relationship between co-people. Take into account the after the whenever choosing a good co-applicant:

- Trustworthiness: Choose people your faith to help make the loan money punctually and take the duty of your mortgage seriously. Think of, you can feel guilty of a complete amount borrowed if for example the co-candidate can not make called for financing repayments.

- Creditworthiness: Whenever one co-candidate features good credit, this will boost the chances of providing approved into the financing and you may result in significantly more good loan terms.

- Communication: Like a person who interacts better along with you sufficient reason for whom you is talk about the financing conditions and you may fees package without having any conflicts otherwise misunderstandings.

- Relationship: Consider carefully your connection with the latest co-candidate, be it a relative, buddy, team companion, or personal companion. Make sure your relationships can withstand the fresh economic obligation out of co-trying to get a loan and any possible conflicts that arise.

- Mutual needs: Remember to and your co-candidate have the same desires in mind to the mortgage financing, whether or not they are to have renovations, debt consolidating, or a primary buy. Talk about the loan’s purpose and make certain you’re on a comparable page.

Simple tips to sign up for an unsecured loan with an excellent co-applicant

The process to own applying for a personal loan with an excellent co-applicant matches when using yourself. You’ll search loan providers and compare prices, words, and you will charges. The major distinction is the fact you’ll also deliver the personal information of the co-candidate in addition to oneself.

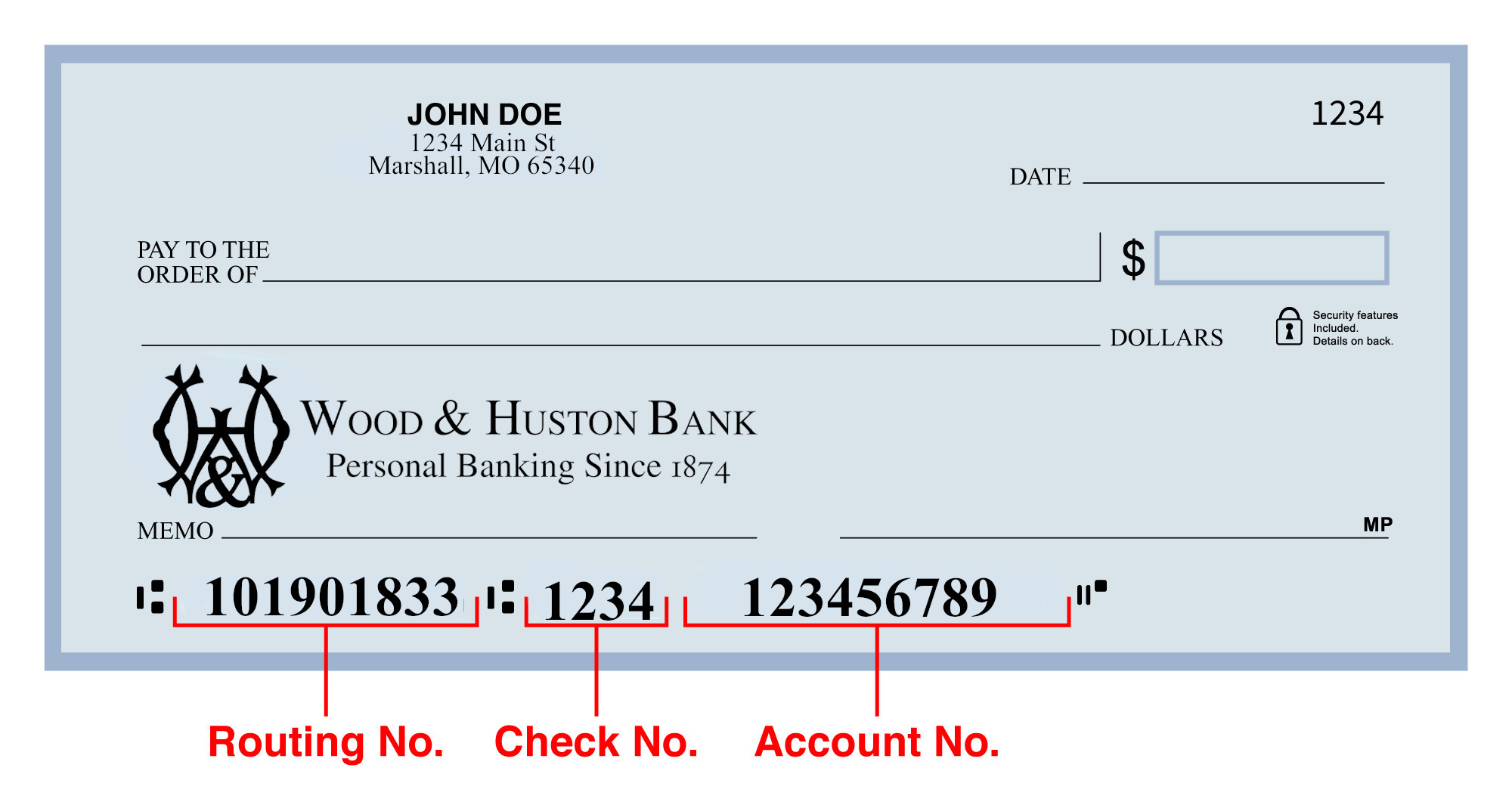

- Label, target, and you may Social Shelter count

- Earnings

- The expenses

You happen to be asked to include documentation including spend stubs, bank account comments, otherwise tax returns to confirm your debt-to-earnings ratio, a career, and you may a good costs. Loan providers will see the credit score and you will credit history away from each other individuals whenever choosing whether or not to offer the borrowed funds.

Is a beneficial co-candidate be removed from a personal bank loan?

While it’s possible to eradicate a co-candidate off a consumer loan, it may not be simple. The process of removing a co-candidate is dependent on new lender’s policies together with regards to the borrowed funds contract.

Quite often, the lending company might need the fresh co-applicant’s say yes to come off because co-candidate is actually just as accountable for paying down the borrowed funds, and also the financial must ensure the rest debtor can still repay the loan on their own.

If the co-candidate agrees getting removed, the remainder debtor might need to promote even more documentation and you will proceed through a credit assessment to prove their capability to settle the mortgage by themselves.

Do i need to put multiple co-people in order to a personal loan?

The ability to incorporate numerous co-individuals so you can an unsecured loan depends on this new lender’s principles as well as the regards to the loan arrangement. Some lenders get make it numerous co-individuals, while some may only make it one to.

Really does an excellent co-applicant you want good credit?

Your own co-candidate isn’t necessarily required to features good credit, nonetheless it yes support. When you get that loan with well over anyone, loan providers tend to look at the lower credit history among the many applicants.