You will be always both credit unions and you can banks, however, ever ponder the online payday loan Missouri way they truly change from each other? Credit unions and you may banking companies can also be each other make it easier to open membership, spend less, and you will reach finally your monetary preparations. However, continue reading examine the important differences when considering borrowing unions and you may banking institutions, and which one would-be your absolute best choices.

Finance companies & Borrowing Unions: The Objective

Area of the difference in a financial and a card relationship try one a bank are an as-funds financial institution, when you’re a card union isnt-for-finances. Thus, financial institutions was passionate mostly making payouts for their shareholders.

On the other hand, credit unions such as for example APGFCU, try cooperatives. It means they are belonging to the account holders (also known as users), who have a familiar mission in the organization’s victory.

In place of trying to repay earnings so you’re able to investors such finance companies perform, credit unions pass along income to help you users when it comes to highest returns toward deposits, down and you will fewer charges, and you may reduced rates on the loans and you may handmade cards. Plus, professionals can be weigh-in on the very important choices you to contour the long run of credit relationship.

Because a don’t-for-profit, APGFCU has arrived to focus on you. People gain access to products and services to aid meet every of their financial requires, including to acquire a property, strengthening a corporate, and you will protecting for future years.

Member-Centric Focus

During the borrowing unions, their voice things. Regardless of what far currency you have got to your put, for every single user provides the same choose inside electing the latest voluntary panel people toward providers. Just like the a member, the best passions guide all the device we provide each decision i make.

While the perhaps not-for-money groups, borrowing from the bank unions’ done interest goes to enabling their people achieve economic fitness. At the to have-earnings financial institutions, your e prefer or worthy of as actually a card connection affiliate-manager.

Unit Range

Borrowing from the bank unions satisfaction on their own above-level customer service, struggling to offer individual focus on for each and every representative and getting great worry to be certain pleasure. Of many, eg APGFCU, have totally free tips in the way of economic studies coating a number of information for the economic well-becoming.

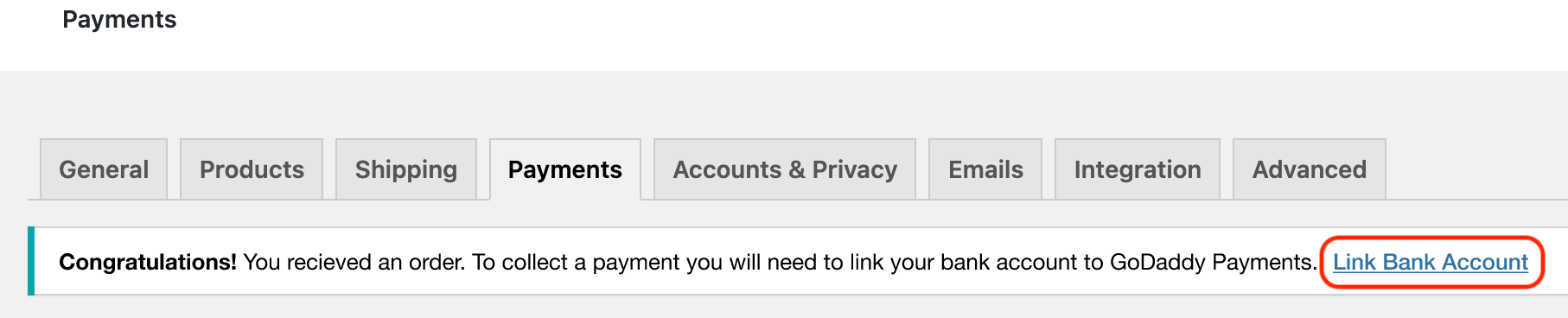

Competitive Cost & Reasonable Charges

Financial institutions and you will borrowing unions each other earn money from lending finance at high interest levels than simply they pay out on the deposits, and compliment of charge.

Yet not, borrowing from the bank unions generally speaking render top costs minimizing charges just like the notice is on returning profits so you’re able to users, in lieu of outside buyers. step 1 Are perhaps not-for-funds produces credit unions exempt away from a few of the fees finance companies have to pay. 2

Defense off Banking companies & Borrowing from the bank Unions

Each other financial institutions and you will credit unions give you the same quantities of deposit insurance around $250,000, secured and you can supported by the government. step 3 Finance companies is actually covered of the Government Deposit Insurance Firm (FDIC). Borrowing from the bank unions belong to the fresh Federal Credit Partnership Administration (NCUA), that is much like brand new FDIC having financial institutions.

Proudly Local, Just like you!

Credit unions are usually concerned about the community in which they live. The reason being borrowing unions show a common thread to possess registration, such as for example lifestyle otherwise involved in a similar town. Borrowing unions play a crucial role inside the improving the top-notch lives within groups of the not merely providing essential money plus actively stepping into volunteerism, exemplifying the commitment to putting some towns and cities it suffice top and you may far more sturdy.

APGFCU also have planned brand new youngest area users by providing young people subscription discounts makes up about ages delivery so you’re able to 18, which have pros progressing because the players expand.

A perfect objective should be to improve the lives of the many people on society. Such as, mouse click less than to learn on the APGFCU’s contribution you to definitely served the construction out-of yet another basketball complex for in another way abled children inside the Harford County.

This particular article might have been sent to academic motives simply that’s maybe not designed to replace the pointers out-of financing representative otherwise monetary advisor. This new advice given in blog post was getting examples just and you can might not affect your role. As all of the problem is different, we advice speaking to that loan representative or monetary advisor from your unique demands.

- APGFCU 2024

- Navigation Count 255075576

- APGFCU PO Container 1176, Aberdeen, MD 21001-6176

- Phone: 800-225-2555

- APGFCU NMLS # 480340APGFCU NMLS Registry Numbers

If you utilize a display audience and so are having trouble with this particular site delight fool around with our usage of contact form otherwise phone call 410-272-4000 otherwise cost-free at 800-225-2555 for recommendations.