If you are just one mother surviving in a rural town for the Michigan, you should know among the many mortgage loans given by this new Us Department away from Farming.

USDA financial standards are not as tight while they is actually getting traditional fund since they’re built to remind men and women to move into rural components.

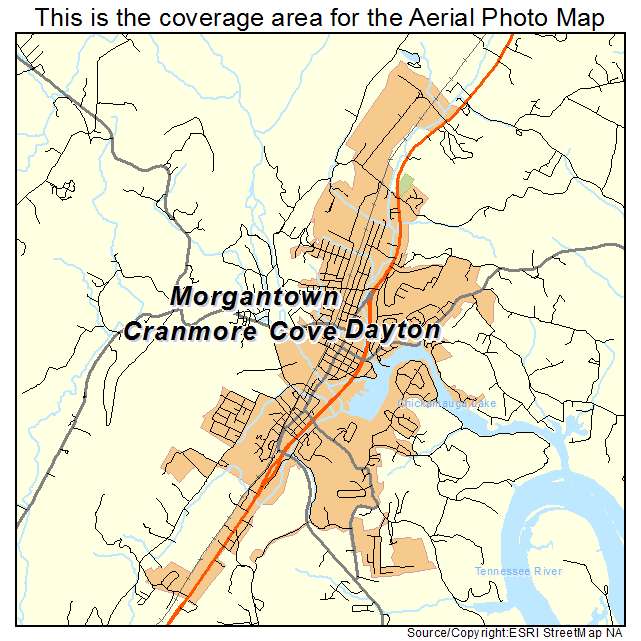

Searching for lower income housing when you look at the Michigan to own unmarried moms and dads but nevertheless should inhabit the town? You happen to be amazed as to what new USDA matters since a rural area, and as much time as you reside in the latest suburbs otherwise outskirts out of a more impressive area eg Detroit you might still be eligible.

Virtual assistant loans

Va fund are only eligible to single parents from inside the Michigan which are also latest or former people in the latest armed characteristics. Much like FHA funds, Va money is a home loan to own unmarried mothers inside the Michigan that’s insured because of the federal government (in cases like this, by the Service of Pros Facts.)

Va Financing have no minimal borrowing specifications (no matter if with good credit usually assists), zero individual mortgage insurance policies, without downpayment.

Really loan providers usually nonetheless wanted a debt-to-money proportion of approximately 41 percent getting a Virtual assistant mortgage, but when you comparison shop you will be able to get a large financial company during the Michigan who may have ready to accept one thing down.

These fund are perfect whenever you can make them as they save you thousands of dollars eventually. They make they an easy task to look for lower income property inside Michigan to possess solitary mothers.

If you are not eligible for a number of the Michigan authorities guidance getting unmarried mothers or simply just perhaps not trying to find applying, there might be additional options getting lower income construction when you look at the Michigan for unmarried parents.

Conventional Home loans

Commercially, a conventional home loan is actually an alternative nevertheless the conditions it has actually you’ll find not as beneficial as the FHA, Virtual assistant, or USDA has actually. Conventional financing always want an up-front payment away from 20% of one’s residence’s overall value and you can the brand new payment from costly private home loan insurance coverage (PMI) for the majority of of your own home loan period. Along with, higher credit standards often hanging within the 650-700 range. In short, these fund was personal and you may pricey.

However, you’re in a position to secure a conventional home loan just like the an effective Michigan unmarried mommy and no money If you possibly could look for anyone to co-sign they to you. Good co-signer was some one bad credit line of credit online (usually a reliable buddy otherwise romantic relative) whom believes so you’re able to wrap the credit to your possessions reciprocally to have better terms to your home loan.

It is an alternative that can come with a lot of dangers, but if you plus co-signer try confident in what you can do to pay off the mortgage it could be a massive help.

Rent-To-Own Low income Construction In Michigan

If you’re unable to get property, you can book one to. That’s one way to discover low income housing during the Michigan having unmarried moms and dads. But what if you find yourself in fact trying to find a long-term place to real time?

Really, you can remove a rent-to-very own price. This is certainly a simple local rental deal, which means that it is more comfortable for lower income people to afford than simply a conventional home loan. Yet not, in addition boasts a non-refundable potential choices fee which have to be paid back upfront.

Which compensates the latest landlord when deciding to take the home off the markets and provide this new renter the chance to find the possessions in full at the end of brand new leasing several months.

Once that occurs, you’re going to have to search extra funding on a single of one’s most other programs above. However, leasing to have lets you come across housing about brief name as you cut back having a larger down-payment in the the future.