They pride on their own into knowing how their moms and dad organization’s structure timelines performs which means that your family (and) financing remain on schedule.

It means you may be capable of getting your hands on a reduced home loan price you to outside lenders simply cannot defeat.

Read on to learn more about these to know if they might possibly be a great fit to suit your financial means.

Promote Home loans Even offers Large Rates Buydowns

- Direct-to-consumer lending company

- Has the benefit of house buy fund

- Founded inside 2016, headquartered inside the Newport Coastline, California

- An entirely had subsidiary of Century Organizations

- Moms and dad organization is in public places exchanged (NYSE: CCS)

- Signed up so you can give in the 18 claims across the nation

- Funded regarding $2 mil in home money inside the 2022

- Most active during the Ca, Texas, Georgia, and you will Texas

- And works a name providers and insurance https://paydayloancolorado.net/glenwood-springs/ agency

Promote Home loans is a completely possessed part regarding Century Communities, which supplies so you’re able to-be-centered and you may short disperse-for the land into the some claims all over the country.

Its number 1 notice is offering house pick money to help you consumers out-of newly-created homes in the of a lot groups they perform on nation.

He’s subscribed inside the 18 claims, and Alabama, Washington, California, Colorado, Fl, Georgia, Indiana, Louisiana, Kentucky, Michigan, Nevada, New york, Kansas, Sc, Tennessee, Texas, Utah, and Washington.

Similar to almost every other builder-affiliated lenders, Promote Mortgage brokers also works a concept insurance policies and you will payment organization named Parkway Term, and you can an insurance coverage company titled IHL Homeowners insurance Institution.

It indicates you can certainly do one-prevent looking for all your valuable financial requires, even if it is usually wise to search around for such 3rd-people attributes too.

How to begin

You can either go to a good Century Organizations new house conversion workplace locate matched with a loan officer, or simply just go online.

For those who head to their website, you can simply click Pre-qualify Now to access a loan officer index you to listings the many teams operated from the the parent team.

Once trying to find a state, you’ll be able to discover a residential district to determine what loan officials suffice that one advancement.

Following that, you will notice contact information and you may be able to score pre-eligible for home financing or log in if you’ve already applied.

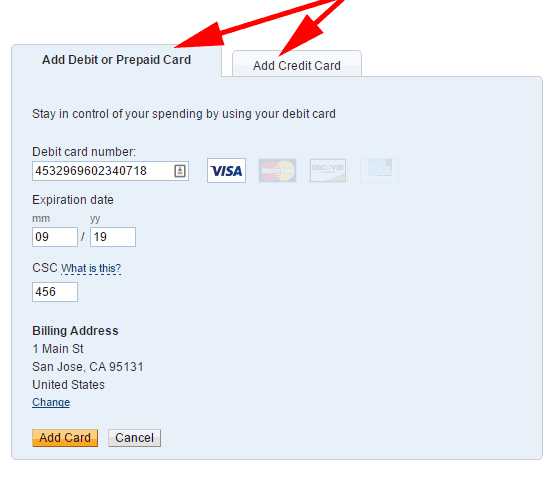

Their digital loan application is powered by fintech business nCino. It allows one eSign disclosures, hook economic levels, and you can complete the app of one device.

You can slim on your faithful, individual mortgage cluster which can be found to greatly help and provide responses whenever you possess concerns.

They look giving a beneficial balance of both tech and you will human touching to get you to the conclusion range.

And since they are affiliated with the builder, they shall be able to discuss easily and maintain your loan to the track based on construction condition.

Financing Software Provided

When it comes to loan choice, they will have every significant financing applications property consumer you can expect to you desire, along with conforming money, jumbo financing, additionally the complete selection of government-backed money.

The new Ascent Club

This could include learning how to cut having a downpayment, how to build resource supplies, just how to improve fico scores, and also change your DTI ratio.

And you can whether you are a first-date household visitors otherwise veteran, it conduct 100 % free webinars to resolve people home loan concerns you are able to enjoys.

Encourage Mortgage brokers Costs and Charge

They won’t checklist its home loan costs otherwise lender charge on the internet, hence isn’t really atypical. However, I do offer lenders kudos once they do. It is a bonus from a transparency perspective.

Therefore we don’t know how aggressive he is in line with most other loan providers, nor can we determine if it charge financing origination payment, underwriting and you will handling charges, app fee, and so on.

Definitely inquire about all fees after you very first talk about loan rates which have a mortgage officer.

When you are getting an increase price, one to plus the financial charges makes up their home loan Apr, which is a definitely better way to examine mortgage costs regarding bank so you’re able to financial.

One example given a 2/step one buydown to 3.5% for the first 12 months, 4.5% into the season a few, and 5.5% fixed on the remaining twenty-eight age.

That’s rather tough to defeat whenever home loan prices was next to 7.5 now%. This can be one of the many benefits associated with using the builder’s mortgage lender.

But as usual, take time to shop your price together with other loan providers, borrowing unions, mortgage brokers, and the like.

Inspire Home loans Analysis

Although not, he’s a-1.8/5 with the Yelp from about 29 recommendations, though the shot dimensions are of course slightly small. At Redfin he has a far greater cuatro.4/5 of seven reviews, and therefore once more was a tiny decide to try.

You are able to search the individual practices from the nation for the Yahoo to see recommendations by venue. This is often way more beneficial if you use a specific regional place of work.

The mother company keeps an enthusiastic A+’ score towards Bbb (BBB) website and also become qualified since 2015.

In spite of the strong letter stages get, they’ve a poor step one.05/5-star score considering more than 100 buyers ratings. This might relate to their numerous grievances registered more than recent years.

Be sure to take care to search through a number of them to find out how of several relate to the credit division rather than their new home-building device.

Naturally, its likely that while using Promote Lenders to obtain good financial, you will be including to find good Century Groups possessions.

To help you share something right up, Motivate Lenders has got the current tech, an excellent assortment of financing apps, and may even render cost specials one to outside lenders can not contend with.

He has got certain blended critiques, however, mainly confident ones, even in the event the mileage can vary based on the person you work on.

Still, take care to shop third-group loan providers, brokers, banking institutions, an such like. Along with other has the benefit of at your fingertips, you could discuss and potentially land an even best contract.