USDA/RHS Mortgage: Brand new americash loans Fyffe USDA/RHS financing helps residents otherwise outlying areas get funding to own an excellent mortgage. To help you qualify, you really must have a steady money zero higher than 115% out-of modified area median money on your own state.

Jumbo: A good jumbo mortgage are a mortgage you to definitely is higher than compliant financing limitations, according to the Real estate Institute. Extent one qualifies because the a great jumbo mortgage differs because of the county. Particularly, within the Los angeles, a loan of $679,650 qualifies as an excellent jumbo mortgage, but in most other states it is $453,100. Jumbo financing are higher risk, very you will need to possess a large advance payment and you can a keen advanced level credit rating.

Conforming: A conforming financing simply a loan one falls for the old-fashioned conditions put up by the Fannie mae and you may Freddie Mac computer.

The brand new short address: the mortgage you be eligible for. But not, just because youre eligible for a loan doesn’t mean your will be bring it. You’ll want to look at the positives and negatives away from providing away loans with a high interest (along with highest monthly payments) otherwise an extended installment term (you only pay more over the category of your mortgage).

13. Rates: What is actually regular, as well as how manage I’ve found aside what exploit try?

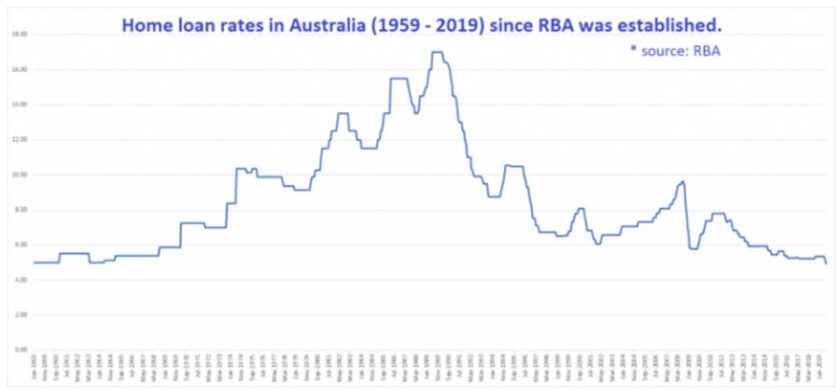

Loan interest rates alter frequently. At the time of guide, the typical 30-12 months fixed speed financing was 4.73%, additionally the 5/step one Arm (adjustable) was 4.10%. The best rate is 19% inside the 1981. However,, as homes drama for the 2008, the newest pricing provides resided under 6%. Within the 2017, the typical claimed rate are as much as cuatro.1%.

There are several an effective way to guess exacltly what the interest may be using on line calculators, but your best bet is always to chat with your own financial. They’ll certainly be able to give your a much better concept of exactly how low or higher your price you are going to be.

14. Can there be one thing I will do to lower my personal interest rate?

When you’re getting ready to get a house, you can decrease your upcoming interest by the enhancing your borrowing score. Even a big difference out-of ten points decrease the rate. Concurrently, you could potentially render a larger advance payment for the mortgage.

For people who currently have home financing, it’s also possible to consider refinancing to possess a lesser price. You ought to talk to your financial to choose if it’s a suitable time or if you is wait a little lengthened toward cost to regulate.

If you’re undergoing purchasing property and you will your suspect the attention pricing are about adjust, you can pay your own lender in order to protect their interest. Thus no matter if cost jump through to the bank techniques the borrowed funds, yours wouldn’t change. The price tag is typically anywhere between .5 % and dos percent of the total financing.

You will find benefits and drawbacks so you can opting for an expense secure. You could potentially save money when the rates of interest rise. Yet not, rates you’ll shed (which means you would-be using more your believe). At exactly the same time, the brand new rates may well not change at all, therefore you can expect to still have several thousand bucks marked to the loan.

16. Must i prefer a predetermined-rates otherwise a varying-speed financial?

There’s no perfect answer. Variable speed fund may be more straightforward to be eligible for, however when the pace alter, very do your monthly payments. From a budgeting direction, this can be a discomfort. Should you imagine a varying-speed mortgage, perform some research first. You ought to know the way the speed changes, if there’s a limit on the high interest, and also the maximum your speed can go up on a yearly basis.