If you find yourself approved getting an excellent HELOC, you have entry to a line of credit. The total amount you might be eligible for is also influenced by the fresh collateral in your home, and HELOCs plus try to be the second mortgage.

You might be absolve visit this website right here to withdraw as often dollars since you need (to the fresh new restrict) inside the mark several months, constantly anywhere between four and you may a decade. Additionally, you will result in notice-merely money during this windows. In the event that draw several months ends, you could potentially not any longer availableness funds, and you may start making dominant and you can interest repayments to possess good age ten so you can twenty years.

Even when home security money and HELOCs try comparable, there are some type of differences between the two. Domestic security funds leave you all currency at a time that you pay right back through the years. But a beneficial HELOC will give you usage of good revolving type of borrowing from the bank, and also you only have to pay everything you acquire. Together with, home equity fund has repaired interest levels, while making monthly obligations significantly more predictable. In comparison, HELOC fund fool around with adjustable interest levels, that make monthly payments less foreseeable.

The many benefits of Having fun with a property Guarantee Loan getting Do-it-yourself Systems

If you are intending property update enterprise, a property collateral mortgage is going to be a good financing. House guarantee funds promote several advantages so you can residents seeking financing renovations or any other tactics.

Potential Increase in Family Worthy of

Towards the best improvements, you can potentially enhance the property value your home. Eg, upgrading kitchen cupboards, repairing structural activities, and you may handling other areas will help your house command increased speed later. Consult with an educated realtor to inquire of your renovation’s possible influence on the home’s worthy of. You should assess the time and price of the house renovation additionally the prospective Value for your dollar prior to spending currency with the investment.

Aggressive Rates

The speed rather influences how much cash you only pay over the years. According to sized the mortgage, one payment point increases your own purchasing from the hundreds of bucks a month. You will get investment that have credit cards otherwise personal bank loan, however these borrowing products keeps high rates of interest than what you can expect at home security fund. For that reason, they aren’t needed to fund renovations since you could purchase numerous hundred if you don’t thousands of dollars far more in interest.

Repaired Monthly payment

You are going to take pleasure in a predetermined payment per month which are often has worked into the monthly finances. The speed is also repaired, so that you need not worry about change into month-to-month percentage along the loan identity. Fixed payments carry out more structure. A property security personal line of credit enjoys a variable interest, but you pay only notice once you borrow against the financing line.

Stretched Fees Several months

Instead of unsecured loans one to basically render cost regards to around three so you can five years, you will get to 20 years to settle your home collateral financing. In addition, the payment extension lets you bequeath the borrowed funds number over way more years, cutting how much cash your debt per month. So it commission construction was a boon for rent property investors which be worried about expose cashflow than simply paying more notice eventually.

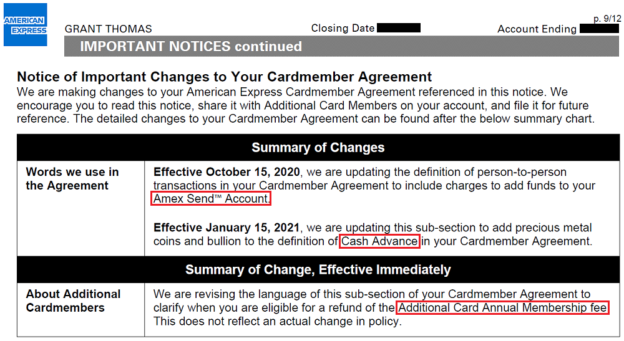

Playing cards and additionally leave you a lengthy months to pay. You just have to make a little minimum payment monthly, however, dragging out repayment could cost you tons of money inside attention. You will also have in order to compete with a costly payday loan fee for individuals who wade that channel along with your charge card.

Tax Masters

The interest paid on the property collateral financing could provide you with tax slices if you itemize write-offs. Family renovations also can lower your goverment tax bill. You simply cannot fool around with a house improvement enterprise since the an income tax deduction whether or not it goes, you could add these to your own house’s costs foundation. A higher cost base minimises your resource development and you will, consequentially, their taxes. You are going to need to track your residence improvement plans as well as how far you may spend. Speak with a taxation preparer more resources for just how it itemized deduction really works while its available to choose from.