Maintaining financial money once declaring insolvency is key. Even after clearing the money you owe, its important to keep expenses timely to help keep your family. Restructuring your expenses might help carry out these types of costs much easier.

Maintaining Normal Mortgage repayments

Keeping up with your own month-to-month financial money is essential, specifically shortly after declaring personal bankruptcy. Whenever you are declaring bankruptcy proceeding can supply you with a start with wiping aside particular expense, it will not cancel out the home loan.

This means you continue to owe the lending company per month. Failing to pay punctually you will put your domestic at stake regarding foreclosure, where mortgage brokers requires right back your home.

To keep focused, envision tweaking your finances in order to prioritize their financial above almost every other expenditures. As bad credit mortgage loans commonly wiped clean when you look at the case of bankruptcy, while making these types of costs is top out-of attention.

You might like to must consider refinancing selection along the line to reduce those people month-to-month wide variety possibly. Staying newest that have money helps keep a confident connection with your professional loan providers and you can leads to rebuilding credit throughout the years.

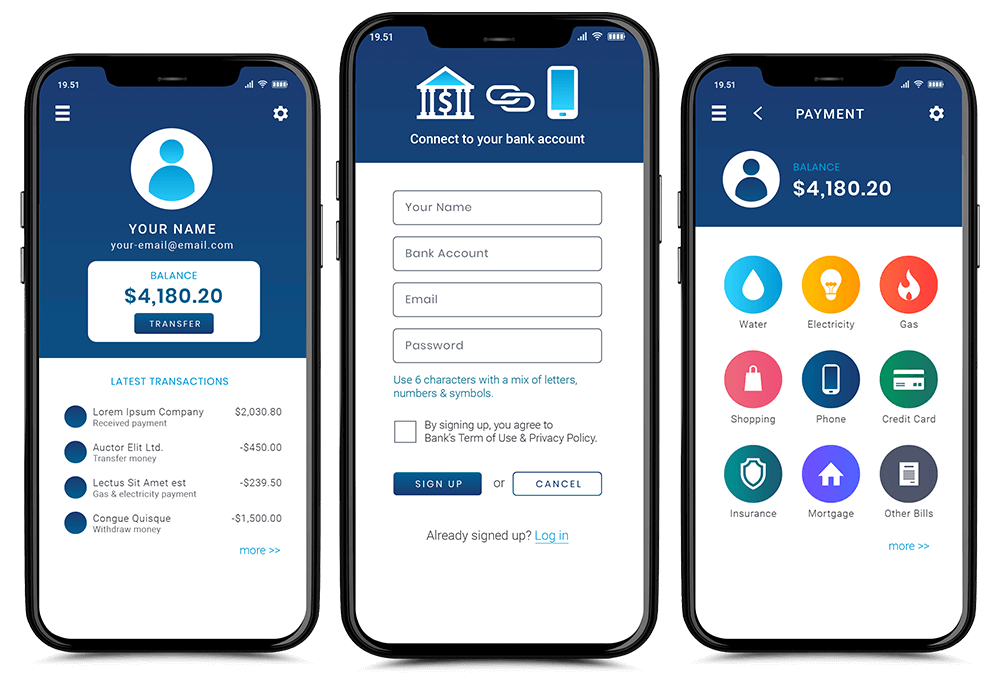

Reallocating Finances Article-Debt relief

Immediately after bankruptcy proceeding, of several select they have more funds monthly. This occurs while they not pay to the most other expense. Someone are able to use this more income while making their house home loan costs.

And work out these types of costs on time is essential to own keeping your family shortly after bankruptcy and you can boosting your credit history plus credit score throughout the credit report.

The new budgeting independence also allows people to think refinancing the mortgage with a brand new home loan software. Financial just after personal bankruptcy otherwise refinancing you’ll down monthly payments or treat the latest loan’s interest rate. It’s a action so you’re able to rebuild borrowing and you will safe financial balances post-bankruptcy.

2nd, we’ll explore how refinancing options are very different ranging from government-supported funds like FHA money, Virtual assistant funds, and you may conventional mortgages shortly after case of bankruptcy launch.

Achievement

Facing personal bankruptcy can be put your home’s upcoming in the uncertain oceans. The state Receiver you are going to want to sell, aiming to pay-off bills for the guarantee you have centered. Should your domestic does not have equity, offering might not happens immediately, but the state you may alter if its worthy of develops.

Yet ,, existence at the top of home loan repayments offers a combat options to keep your quarters despite monetary turmoil. Service from certain groups may also show you thanks to these problematic times, ensuring you’re not going right on through that it travel by yourself.

Faqs

When you seek bankruptcy relief, an automatic stand halts business collection agencies as well as your family home loan. However, the cash loan Blue Sky, CO latest specialist mortgage brokers can invariably foreclose on the household in the event the repayments aren’t made.

2. Should i remain my household just after submitting A bankruptcy proceeding personal bankruptcy?

Yes, it utilizes numerous points such reaffirmation preparations and you may whether or not or otherwise not your own guarantee is actually excused not as much as Chapter 7 laws and regulations. You may have to remain using very first otherwise second financial.

step three. Will a bankruptcy proceeding affect my capacity to re-finance or score an effective the fresh new home loan?

Bankruptcy proceeding may affect fico scores which can determine home loan costs given by the lenders for example J.P Morgan otherwise Rocket Enterprises Inc., making it more challenging in order to re-finance or score yet another financing.

cuatro. How come Section 13 bankruptcies range from A bankruptcy proceeding whether or not it involves house?

Section 13 bankruptcies create reorganization regarding expenses and could allow you to catch up towards the skipped costs over time as opposed to dropping assets as opposed to for the a bankruptcy proceeding where property is liquidated.

5. Can be the financial institution need my home basically keeps submitted getting bankruptcy proceeding defense?

For people who standard on your own mortgage repayments, the fresh mortgagor has legal rights so you’re able to initiate foreclosures selling actually during the a keen lingering bankruptcy proceeding case unless of course protected by federal property power laws.