Third-cluster VOE organization discover current payroll advice directly from new employee’s HR/payroll departments. These records is reposed in the safe databases and is updated for each and every day the new boss operates payroll. The details consists of most, otherwise all of the, of the research entirely on an enthusiastic employee’s paystub in addition to such as products since terrible and you will websites pay and you can deductions. Addiitional information connected with the newest staff is additionally offered such as for example start date, a position status or any other study which can be highly relevant to this new employee’s position for the organization.

Because this info is updated each time payroll is work at, always per week otherwise bi-each week, the data will likely be included in the loan document in place of delays or errors that have to be corrected afterwards.

Hence dealers would Verification out-of A career (VOE)?

The great benefits of using these automated features are clear. Affirmed providers can also be receive a consult from a lender 1 day 24 hours/7 days a week, fulfill tricky (and high priced) state/federal compliance criteria, render instantaneous (or near-instant) overall performance, and gives most of the related and you can vital information payroll investigation, provided properly because of the employer. Simultaneously, they could services batch demands and offer more investigation than a straightforward verification away from employment, further speeding up efficiencies and you will reducing closure minutes.

One common wrinkle/complications for the work verification are dealing with a home-operating borrower. Approximately up to fourteen.nine mil Us americans are mind-working, a considerable chunk of your mortgage sector. In this instance, lenders might need consumers to provide an internal Cash Service (IRS) Setting 4506-T, which demands a good transcript of its income tax get back. With this document available to you allows the borrowed funds lender discover a duplicate of borrower’s tax returns right from this new Internal revenue service. Lenders may demand regulating filings otherwise consider certification bureau databases.

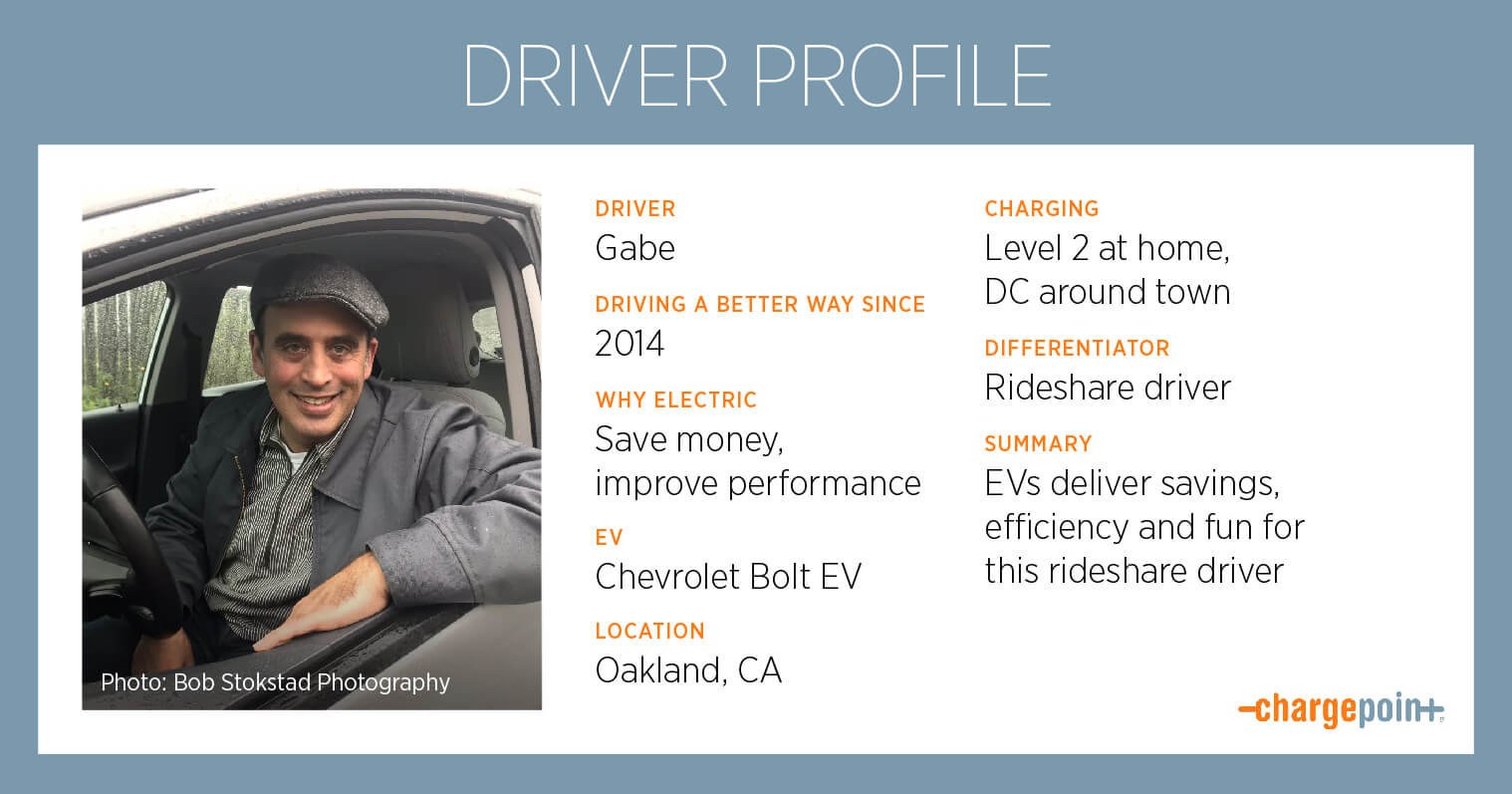

Having so-entitled gig savings specialists, verification regarding a career through an outsourced seller would-be vital, while the employment facts are superimposed and may even transform easily, placing a made for the upwards-to-go out pointers.

Questions to inquire about whenever choosing a good VOE merchant

Prior to making a key regarding an out in-household strategy to a contracted out otherwise 3rd-people VOE service, you can find a number of questions loan providers is always to inquire away from an excellent partner that is prospective, including:

payday loans Glenwood Springs- What exactly is your change time? Having a precise estimate out of a constantly hit timeline is a must to form proper traditional together with your underwriting cluster, mortgage officers, and ultimately, individuals and you will traders. Be skeptical of one’s feeling one to rapid progress otherwise procedure/technical change may have on your provider’s turn moments.

- Exactly what data is used in profile? Another essential bit of information to understand-what’s going to your underwriters/processors be looking at the when they discovered debtor accounts? How does one to line-up along with your portfolio otherwise individual guidance?

- What are the costs? Examine which cost (and people change/implementation can cost you) from what you are already spending to possess when you look at the-house team locate, screen, document, and securely shop one to investigation.

- Is your provider recognized because of the people individual associate and guarantee rescue program? Much more loan providers (and more than of its technology heap) make use of and you can consist of having properties such Fannie Mae’s Day1 Confidence and you can Freddie Mac’s Loan Tool Advisor, it is critical your VOE solution was compliant.

- Speaking of consolidation, its imperative to consult your present technology heap partners to ensure the addition of any VOE technology level will maybe not end up in one misalignment. In fact, of the dealing with your own leading technical lovers-LOS (Mortgage Origination Program), POS (Section from Deals), AUS (Automatic Underwriting System), CRM (Customers Relationship Management), while others-you may find aside they’ve had greatest/tough experience working with certain VOE systems, next advising the choice-and work out process.