The fresh Statute out of Limits getting credit card debt are a rules limiting the amount of go out lenders and collection agencies need sue people for nonpayment.

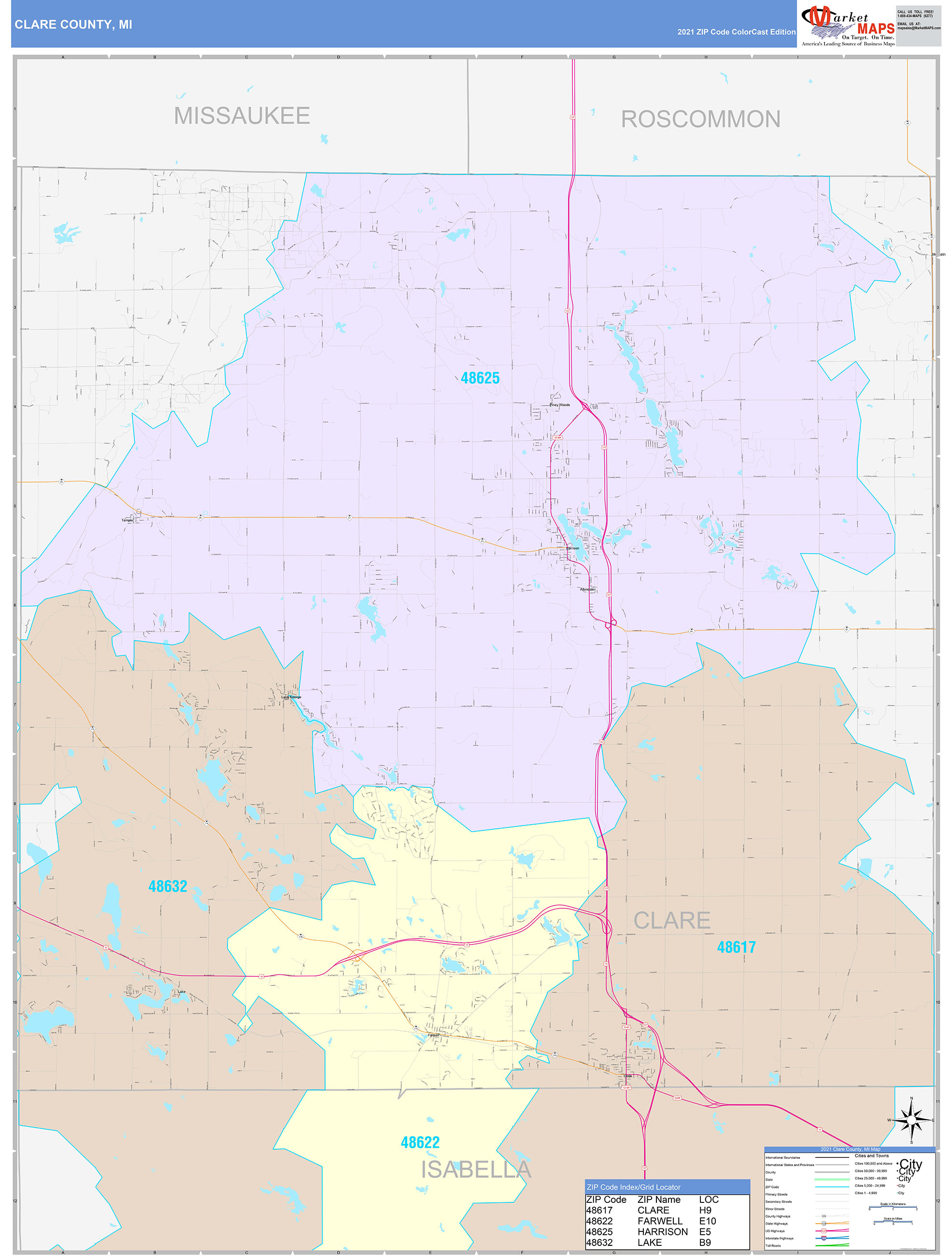

The period physique is determined from the per condition and you can differs from merely three years (during the thirteen says) so you can 10 years (two claims) for the other twenty five claims someplace in anywhere between.

The objective of a statute of restrictions having credit debt should be to end financial institutions out of bringing users to legal even after proof the debt has been thrown away or vanished.

If online payday loan New Mexico the financial or personal debt enthusiast wins a courtroom judgment up against a customer, it opens up the entranceway on several options to have meeting the debt, together with salary garnishment and you can taking on possessions.

What is actually a law away from Limitations on Personal debt?

You to definitely statute regarding restrictions are your state legislation one to set an effective due date into the amount of time you to definitely functions need initiate courtroom process facing individuals getting delinquent financial obligation.

Regulations doesn’t take away the obligations, it simply limitations the amount of time figure you to definitely a collector otherwise collection department has to take lawsuit to get it. The amount of time physical stature differs from state-to-condition but is essentially step 3-6 ages.

It frequently arises into the municipal things where personal debt try considered time-prohibited, meaning the newest statute of limits features expired. Litigation and you can threats out of lawsuits is actually banned in the event the circumstances is actually time barred.

Still, consumers cannot consider the law away from limitations a beneficial Get out of Jail, Free card. You still owe your debt, additionally the range company has got the straight to realize tries to give you pay they. They simply are unable to elevates so you can court over it.

Form of Obligations

The new statute away from limitations can put on to unlawful otherwise civil proceedings and you will laws and you will big date limits consist of condition-to-county, according to seriousness of the crime.

This new statute from restrictions usually will come in during the civil rules times associated with borrowing and you can credit. They are sort of obligations where in fact the law away from constraints is actually involved:

- Open-ended financial obligation: An open-finished financial obligation try a phrase for all the loan that doesn’t enjoys a definite stop day having payment, like credit cards otherwise line of credit. New debtor normally draw to the loan as many times just like the it desire to, up to an effective pre-recognized amount,

- Authored package: That is a released contract ranging from a lender and borrower claiming the amount of money loaned, rate of interest and you will fees to have borrowing from the bank and you will repayment terms.

- Dental price. This really is an agreement that is spoken, yet not make a note of. It is believed legitimately binding, but demonstrating its lifetime will likely be tough.

- Promissory mention: This is exactly an authored hope of the a debtor to spend a good certain share on the financial because of the a certain day. The financial institution doesn’t necessarily need to be a lender. It can be a pal/relative or even the organization people works best for.

All of the county possesses its own law out of limits each particular away from debt. Written agreements and promissory cards feel the longest timelines.

Legislation regarding Constraints for each County (During the Lifetime)

It is vital that users remember that statute off limit laws and regulations will vary, based on your location. Eg, Massachusetts, Connecticut, Maine, and New york features half a dozen-12 months law of limits to possess personal credit card debt, if you are nearby New Hampshire’s is simply 3 years.

Your debt doesn’t end simply because it wasn’t compiled on time set by state laws. The user nevertheless owes they, and you can loan companies enjoys a straight to pursue they making bad records about any of it into credit scoring bureaus.

That’s one among of a lot, of several nuances about statute away from limits law. Here are ten a lot more nuances that you need to find out about just before deciding whether or not it assists or affects your situation.