Month-to-month Mortgage payment

The homeloan payment to possess a great $222k house would-be $step one,480. This really is considering good 5% rate of interest and you can an effective 10% down payment ($22k). This may involve projected property fees, danger insurance coverage, and you can home loan insurance costs.

Earnings Required for an excellent 200k Financial

You need to build $74,006 a year to purchase a beneficial 200k financial. I ft the income need with the a good 200k mortgage for the a payment that’s 24% of your monthly earnings. To suit your needs, your month-to-month earnings will likely be throughout the $six,157.

You may want to be a little more conservative otherwise an effective bit more aggressive. You’ll changes which within just how much household should i pay for calculator.

Do the Quiz

Make use of this enjoyable quiz to determine how much domestic We are able to afford. It only takes minutes and you will certainly be capable review a personalized review at the bottom.

We are going to definitely aren’t overextending your financial allowance. Additionally, you will has a soft number on your own bank account just after you get your property.

Do not Overextend Your financial allowance

Financial institutions and you will realtors make more money after you purchase a far more high priced home. In most cases, banking companies have a tendency to pre-agree your for that you could possibly pay for. Right out of the door, ahead of time traveling house, your financial allowance might possibly be longer towards the max.

It is critical to make certain you was at ease with your payment as well as the amount of cash you will have leftover in your finances after you buy your household.

Contrast Mortgage Cost

Make sure you examine financial prices before you apply getting a home loan loanparing step 3 loan providers can save you several thousand dollars from inside the a few numerous years of their mortgage. You might contrast financial rates to the Bundle

You can view latest mortgage prices or observe mortgage pricing today has trended more recent years for the Plan. We display each and every day mortgage rates, style, and you may disregard situations to possess fifteen year and you can 31 12 months financial points.

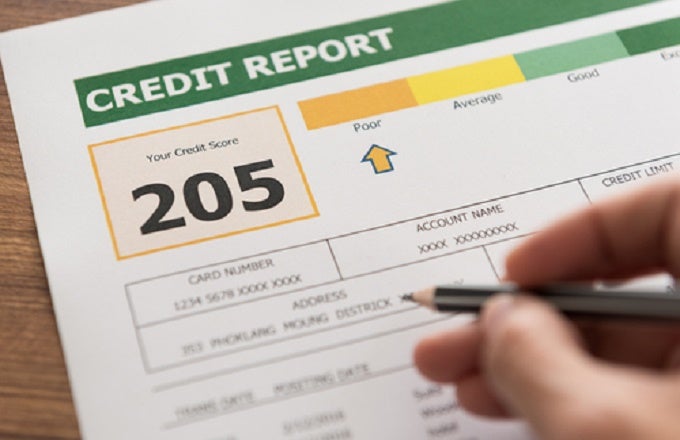

- Your credit rating is an essential part of the mortgage process. When you yourself have a leading credit history, you’ll have a better chance of bringing an excellent accepted. Loan providers tend to be comfortable providing a mortgage percentage one was a much bigger percentage of your monthly money.

- Homeowners organization charges (HOA costs) make a difference your residence to order fuel. If you undertake a property having large relationship fees, it means you’ll want to choose a lower life expectancy charged the place to find to decrease the principal and you can appeal commission enough to provide place on HOA expenses.

- Their other debt costs make a difference to your home Find Out More funds. If you have low (otherwise no) most other financing money you really can afford to visit a little large on your mortgage payment. When you yourself have highest monthly payments to many other funds like vehicle repayments, student education loans, otherwise playing cards, you’ll need to back their month-to-month mortgage payment a small to make sure you feel the budget to blow all of your current expenses.

A long time ago, you needed to create good 20% downpayment to cover the a property. Now, there are many different financial products which will let you generate good far smaller downpayment. Here you will find the downpayment requirements to own popular financial affairs.

- Traditional funds require a 5% deposit. Particular first time homebuyer apps ensure it is step 3% off repayments. A few advice was Domestic Able and you can Family You can easily.

- FHA loans wanted a step 3.5% down payment. So you can qualify for a keen FHA loan, the house or property youre to buy must be much of your quarters.

- Virtual assistant loans need an effective 0% advance payment. Productive and resigned military staff is generally qualified to receive an effective Va financing.

- USDA fund require an effective 0% down payment. These are mortgage loans that are available in rural areas of the newest country.

Exactly what are the strategies to purchasing a home?

- Fool around with some financial hand calculators. Begin getting more comfortable with all of the expenses associated with to shop for a good family. Most people are shocked once they see how far more assets fees and you may home insurance adds to their commission every month.

- Check your credit score. Of a lot banking institutions often now assist you your credit score for free. You can also use a software such as borrowing from the bank karma.