Matt Webber are a skilled personal financing creator, specialist, and you may publisher. He has had written commonly on the personal finance, revenue, and feeling regarding tech towards modern-day arts and you can community.

What is a gift Page?

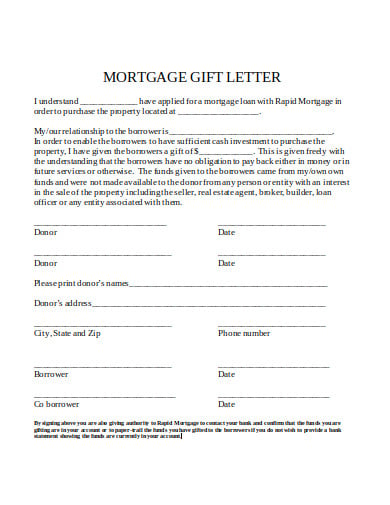

A gift page are an article of judge, written telecommunications clearly saying that money obtained from a pal or relative try a gift. The most used entry to present characters is when a borrower has received recommendations for making a downpayment to the a new home or any other real-estate. For example emails declare that the bucks received isnt anticipated to be distributed back to in whatever way, contour, otherwise function. If you have received something special out-of family relations otherwise members of the family so you’re able to pick assets, their home loan vendor may require you to definitely sign something special letter.

Contained in this book, we’ll glance at just what a present page are, how and just why you can make use of that, and exactly what the taxation implications off presents are.

Key Takeaways

- A gift page is actually an article of courtroom, authored correspondence stating that money received of a friend or relative try a gift.

- Provide emails are very important in terms of purchasing a genuine estate deposit, particularly, just like the loan providers tend to frown abreast of consumers using even more lent currency to possess a downpayment for the a house and other property.

- A loan provider may need a bill to possess something special letter in the event that you can find unusually large places to your bank account best upwards into the purchase of a residential property otherwise a sign of third-team money enabling financing the purchase.

- A gift letter need certainly to secure the donor’s name, new gift’s well worth, verification the provide isnt is paid back, and also the donor’s trademark.

- To possess taxation season 2024, the new annual exclusion on the a present for each people a year is actually $18,000, a rise of $step one,000 more than 2023, according to the Irs (IRS). A beneficial donor would have to spend taxation and you may document something special tax get back towards the any count over one amount.

Common Ways to use Current Letters

A gift letter are a proper document indicating that cash your have received is actually something special, maybe not a loan, and therefore this new donor doesn’t have expectations on exactly how to spend the bucks back.

A gift will likely be broadly defined to provide a sale, exchange, or any other import from possessions from 1 individual (this new donor) to a different (the newest receiver)mon forms of gift suggestions become:

- Cash, take a look at, and other concrete activities

- Transferring a name in order to carries otherwise houses in the place of receiving something inturn

- Forgiving personal debt

- Below-sector loans

Whenever you are current characters was most commonly known having mortgage down costs, they’re delivered to house thought objectives or that https://www.clickcashadvance.com/payday-loans-ca/windsor have a beneficial gift from security. A guarantee current page accompanies a house business lower than market value. It constantly happens when some one gift ideas property so you can a good cousin.

Gift Emails and you can Mortgage loans

Though gift characters normally shelter whatever gift, designed for one purpose, they are most commonly utilized inside process of making an application for a mortgage to get property. Whenever you are to invest in assets, and when you have got gotten a financial gift you package to make use of with the a home loan down payment or settlement costs, then you should provide a present letter to show your money is not that loan.

During the underwriting techniques to have an interest rate, loan providers will get have a look at that loan applicant’s economic situation and you will check if he’s the fresh method for pay back the borrowed funds. While doing so, which more financial obligation could be thought when factoring about costs and you can regards to the borrowed funds arrangement.

Such as, suppose you merely had married as well as your grand-parents provided you $5,000 since a marriage present. You need it money to your an advance payment and you may closure will cost you toward a home, but to achieve this, you’re going to have to reassure their financial vendor this was not a financing.