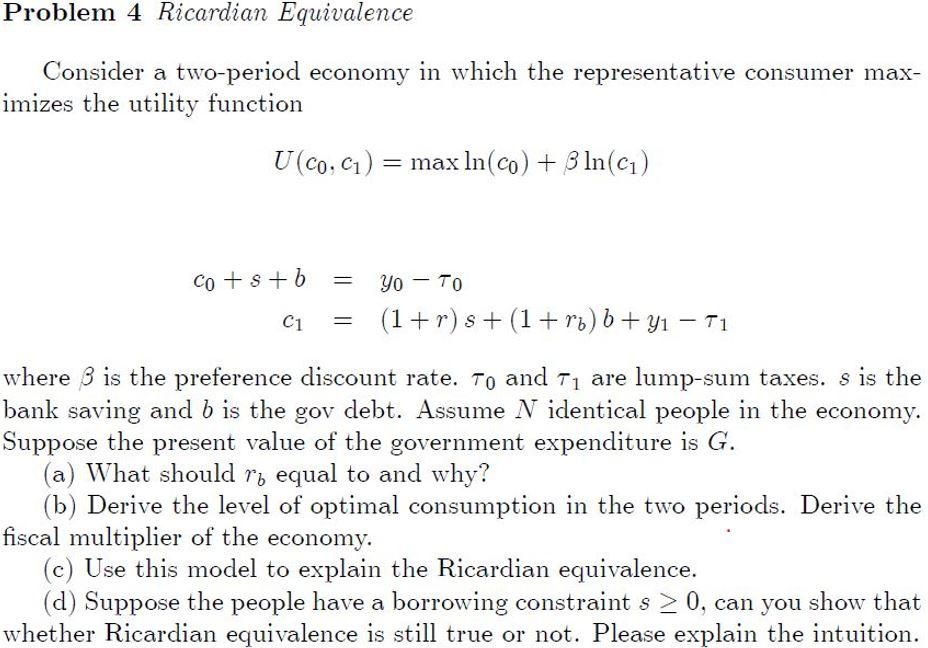

Samantha Stokes, an initial time resident, stands in the front out-of their unique brand new Eastern Garfield Park household one she offers with her teenage d. Stokes is the earliest person to intimate on a house while the part of an alternative program this new Chi town Houses Authority try moving out to have first-big date homeowners. | Tyler Pasciak LaRiviere/Sun-Minutes

When Samantha Stokes’ daughter stepped to their the brand new East Garfield Park domestic for the first time, new adolescent took off their own footwear and you can went around the home.

Members should also have no less than $3,000 inside the offers

Very the very first thing, she goes toward understand the grand garden we enjoys, as well as the garage and things like you to because she’s never had you to definitely in advance of, Stokes remembered. It absolutely was only adventure on her behalf deal with, as well as to this day it’s still unbelievable I’m a real citizen.

On the a month back, Stokes, 38, finalized on her very first house to have herself along with her 14-year-dated daughter. She started investigating to purchase a property the 2009 season after she discovered their own houses solutions coupon from Chi town Construction Power would more than likely phase out due to the fact a recently available employment strategy increased their particular money.

Stokes was a student in the procedure of securing a home through the agency’s Choose to Own system in the event the agency told her in the new Advance payment Guidelines Program these were launching that would render a grant as much as $20,000 for an advance payment and you may settlement costs. Stokes said they decided a perfect violent storm – in the an effective way.

I found myself very personal towards the latest closing time of my personal house, they wound-up workouts well for me, she said.

Samantha Stokes, a first-time resident, really stands on the garden off their own the fresh new East Garfield Playground house that she shares together with her teenage child into Thursday. Stokes ‘s the basic person to intimate on a home since the section of another type of system the latest Chicago Construction Expert are running aside for very first-go out homebuyers, the newest Down payment Guidance System.

Stokes ‘s the agency’s first fellow member to close off into a home as part of the brand new down payment advice system. The fresh new $20,000 will be forgivable shortly after ten years.

You will find already over 12 most other users at the rear of Stokes have been deemed qualified to receive the latest grant and they are during the the process of to invest in property, told you Jimmy Stewart, brand new movie director out of home ownership getting CHA.

New agency projects it will be capable let on 100 people regarding program’s first year, Stewart told you. The applying is financed through federal money from the latest You.S. Institution regarding Housing and you can Metropolitan Development.

If you’re Stokes got a housing voucher from the housing authority, Stewart said the applying is actually open to individuals – in addition to people life beyond Chicago – as long as our home ordered is in the city’s boundaries.

However, the application do include most other eligibility standards, for example getting a first-go out homebuyer who will utilize the assets because their no. 1 residence, he told you. In addition, recipients’ money must not surpass 80% of the area average earnings.

Which means a single adult’s income will likely be at or less than just $61,800, and a family group from three should have a family of money off or lower than $79,450.

The fresh housing authority will love the application form to aid voucher owners who will be approaching 80% of your own urban area median income, meaning he or she is choosing shorter assistance but may be suspicious regarding trying homeownership, Stewart told you. CHA owners just who make right above the 80% tolerance due to transform on their income would be to however implement, specifically because they’re almost certainly toward brink of dropping good voucher or housing guidelines.

The applying will come given that mortgage costs always increase across the country. 57% this past week, the brand new Related Push claimed.

Due to the environment that people can be found in in terms of mortgages immediately and individuals fun to homeownership, Stewart said, we believe this places them in an aggressive virtue and you will lets these to have the ability to purchase the household and then have keeps an easily affordable month-to-month financial number that is its possible as opposed to CHA direction after that.

Stokes received $20,000 from the the construction expert program, also a special $10,000 from another direction program. She plus utilized $5,000 regarding her very own deals to acquire south-west Front, contemporary single-home, which implied as a whole she had only more fifteen% of total cost of the house.

She in past times stayed in a little a few-room apartment, nevertheless brand new home also provides extra space having by herself along with her daughter. Stokes told you this woman is repaying to your their unique home including good bigger cooking area in which she already envisions pupils https://paydayloanalabama.com/aliceville/ playing around throughout future relatives score-togethers. An out in-equipment washing machine and drier function she don’t has to create travel on laundromat.

Their own brothers and you may father provides available to make any needed fixes, although the house is a different sort of design. Their mom, exactly who lives close, has become a regular guest.

Each of them need certainly to choose the extra bed room and you will say that is their space after they already been more than, she said.

The interest rate having a 30-year mortgage flower to help you 7

Samantha Stokes, a first-date citizen, really stands about home away from their own new East Garfield Playground family you to she offers with her adolescent child. Stokes is the very first individual personal on a home because the part of an alternative system the brand new il Casing Authority is moving out getting very first-time homeowners.